All courses

Fresh graduates

- Study abroad

- Offline centres

More

BESTSELLER

Live Instructor-Led

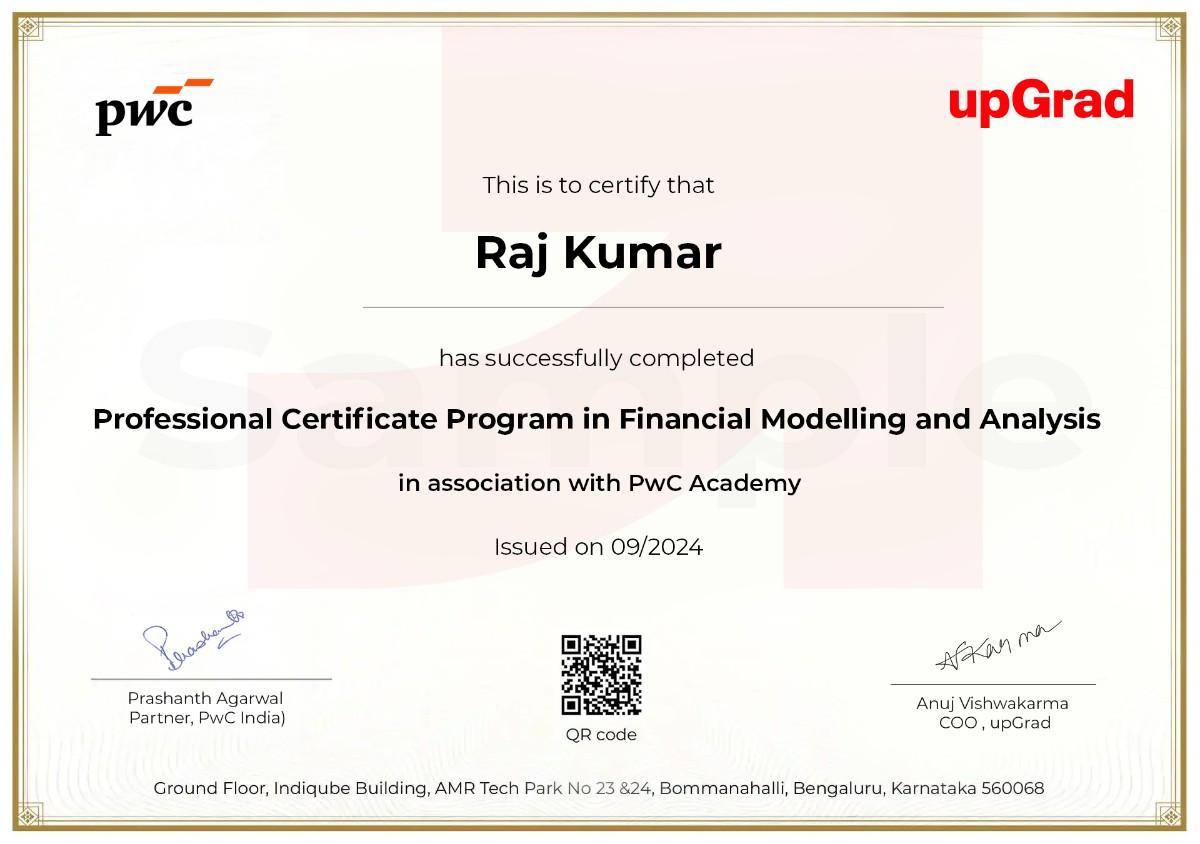

Professional Certificate Program in Financial Modelling and Analysis in association with PwC Academy

Transform Your Professional Journey in Finance with Live Training from PwC India and Top Finance Experts. Join Now.

Key Highlights of the Financial Modelling Course

How This Program will Transform Your Career

Learn Directly from Top PwC Experts

Engage in Live, Focused Learning Sessions

Work on Real-World Financial Projects

Master Tools like Tableau, Power BI

Prepare for a Successful Finance Career

Access Job Portal and Interview Skills

Need to know more about this Financial Modelling Certification?

Get to know the course in depth by downloading the course brochure.

Fast-Track Your Growth in the Finance Industry

Become 360° job ready with the Financial Modelling and Analysis program with its best-in-industry syllabus and faculty

Top Recruiters

Financial Modelling Course Project

Live Industry Projects

Gain hands-on experience by working on real-world industry projects designed to give you a comprehensive view of the financial domain and make your job ready.

4

Industry projects

FMA Bootcamp Tools and Skills

Master 3+ Industry Tools and 9+ Financial Skills

Financial Analysis Skills

Master the domain of financial analysis by building financial statements, conducting financial analysis, reporting financial health, creating financial budgets, and building variance reports

Financial Modelling and Investment Banking Skills

Gain expertise in the domain of financial modeling by building a 3-statement model, a valuation model, and valuing an M&A transaction in investment banking using multiple approaches like DCF, comparable company analysis, and precedent transactions approach

Financial Analytics and Spreadsheet Tools

Master the skill of data analysis and visualization using tools like Microsoft Excel, Power BI, and Tableau

Financial Analysis and Modelling Course Curriculum

Learn with a

World-Class Curriculum

Fundamentals of Finance Operations

This course imparts essential skills required to record and report financial statements in accounting software like Tally, along with treasury operations like bank reconciliation statements.

Topics Covered:

- Tools And Strategies For Managing O2C, P2P, and R2R

- Bookkeeping Process

- Accounting Standards and Principles

- Overview & Preparation of Financial Statements in Tally

- Bank Reconciliation Statement in Tally (BRS)

Financial Analysis using Excel

This course imparts essential skills required to create financial budgets and conduct a financial analysis of an organisation.

Topics Covered:

- Financial Budgeting

- Ratio Analysis, Comparative Analysis, Trend-off Analysis

- Scenario Analysis, Variance Analysis, and Interpretation

Financial Modelling

This course imparts essential skills required to create financial models for valuing a firm.

Topics Covered:

- Time Value of Money

- Overview of Financial Equity Markets

- 3- statement and Valuation Model in Excel

- Scenario and Sensitivity Analysis

Investment Banking - M&A

This course will help you understand the mergers and acquisitions process and the financial models used by investment bankers to facilitate valuations in M&A

Topics Covered:

- Investment Banking

- Key Steps in M&A Transactions

- M&A Valuation Techniques and Models

- Synergies in M&A

- Sensitivity Analysis and Legality in M&A

- Buy-Side Process in M&A

- Post-Merger Integration Phase

Finance Professional Certification Instructors

Whom Will You Learn From?

Our Learners

Our Financial Modelling and Analysis Program Alumni Success Stories

100% PLACEMENT SUPPORT

Career Accelerator

Receive tailored career guidance from experienced industry mentors, helping you set and achieve your professional goals.

Get personalized feedback on your skills, projects, and career plans to accelerate your growth.

Build your professional network through mentor introductions and industry insights.

Access ongoing support to navigate workplace challenges and make informed career decisions.

Our Proven S.M.A.R.T. Learning Formula

Fast Track Your Finance Journey with Our Comprehensive Methodology

1

Study

Live Faculty-led sessions

Detailed Lecture Notes

2

Make

Build Real Financial Models

Solve Hands-On Case Studies

3

Attempt

Challenging Practise Assessments

Problem-Solving Scenarios

4

Revise

Weekly Doubt Resolution Sessions

Comprehensive Review Guides

5

Test

Regular Project Submissions

Personalised Feedback

Financial Modelling and Analysis Course Program

Prerequisites and Eligibility

Students in the last year of college

Fresh graduates

Early career finance professionals with 0-3 years of work experience

Entrepreneurs

Finance professionals

Financial Professional Certification Eligibility

How To Apply

Please find below the detailed steps to be followed as a part of the admission process.

Eligibility

Candidate must be in college or with 0-2 years of work experience

Financial Modelling and Analysis Course Fees

Invest In Your Success

Inclusions

Financial Analysis Learner Services

How will upGrad support you?

Receive unparalleled guidance from industry mentors, teaching assistants and graders

Student support is available 7 days a week, 24*7.

You can write to us via studentsupport@upgrad.com or for urgent queries use the \" Talk to Us\" option on the learn platform.

What is the Professional Certificate Program in Financial Modelling and Analysis?

FAQs on PCP in Financial Modelling and Analysis

1. What is the Professional Certificate Program in Financial Modelling and Analysis?

The Professional Certificate Program in Financial Modelling and Analysis is a 4-month, expert-led certification designed with PwC Academy. It helps learners master financial modelling, valuation, budgeting, and analytics using tools like Excel, Tableau, and Power BI. The program builds practical, job-ready finance skills for today’s global business world.

2. How is this program different from other financial courses?

This program stands out because it’s created in collaboration with PwC Academy and focuses on hands-on learning. You’ll work on live projects, use real business data, and learn directly from PwC India experts who bring real-world finance experience into every session.

3. What makes the Professional Certificate Program in Financial Modelling and Analysis practical?

The professional certificate program in financial modelling and analysis is designed to be application-based. You’ll create actual financial models, perform valuations, and analyze company performance just like professionals do in investment banking or corporate finance. Every concept is tied to a real business scenario.

4. How long does it take to complete the Professional Certificate Program in Financial Modelling and Analysis?

The program takes about 4 months to complete. It’s flexible and designed for both students and working professionals, allowing you to learn at your own pace through live classes, recorded sessions, and guided assignments.

5. Who conducts the sessions for this program?

All sessions are led by PwC India professionals with years of experience in finance, analytics, and consulting. You’ll gain practical insights from experts who apply financial modelling and valuation techniques in their day-to-day work.

6. What certification will I receive after completing the program?

After successfully completing the Professional Certificate Program in Financial Modelling and Analysis, you’ll receive a joint certification from PwC Academy and NSDC, endorsed by the Government of India. You’ll also receive an upGrad completion certificate.

7. Is the PwC Academy certification globally recognized?

Yes, the certification from PwC Academy is globally recognized and valued by employers worldwide. It highlights your expertise in financial modelling, valuation, and analysis, helping you stand out in competitive global job markets.

8. How does the certification help in my career growth?

This certification validates your financial skills and enhances your professional credibility. It can help you move into roles such as Financial Analyst, FP&A Specialist, or Valuation Consultant with better pay and global career prospects.

9. Can I add this certification to my resume or LinkedIn profile?

The Professional Certificate in Financial Modelling and Analysis is a strong addition to your professional profile. It shows recruiters that you’ve been trained by PwC experts and possess the analytical and technical skills needed in finance.

10. What topics are covered in the Professional Certificate Program in Financial Modelling and Analysis?

You’ll learn key concepts like financial statement analysis, valuation modelling, budgeting, forecasting, and M&A fundamentals. The program also includes modules on Excel, Power BI, Tableau, and Tally to help you handle financial data efficiently.

11. Are there practical projects in this program?

Yes. You’ll work on four real-world projects covering areas such as financial budgeting, valuation, scenario analysis, and variance reporting. These projects give you hands-on experience that mirrors actual finance industry challenges.

12. What kind of tools will I learn in this course?

The professional certificate program in financial modelling and analysis focuses on the most in-demand finance tools like Excel for modelling, Power BI and Tableau for data visualization, and Tally for financial reporting. These tools help you analyze and present financial data like a professional.

13. How is the course delivered?

The program is delivered online through a mix of live expert-led sessions and recorded videos. You’ll also have access to assignments, case studies, and mentorship support to reinforce learning and help you apply your skills practically.

14. Who can apply for the Professional Certificate Program in Financial Modelling and Analysis?

The professional certificate program in financial modelling and analysis is open to students, fresh graduates, working professionals, entrepreneurs, and anyone interested in developing financial modelling and analysis skills. No prior finance experience is required, just a passion for learning

15. Do I need a finance background to join this program?

Not necessarily. While a finance or commerce background can help, the program starts with the fundamentals. It’s suitable for beginners and professionals from non-finance fields who want to switch to financial roles.

16. Is there any age or qualification requirement to apply?

There’s no strict age limit. You just need to be a current college student, a recent graduate, or a professional looking to enhance your financial knowledge. Basic computer and Excel skills are helpful for this program.

17. Can working professionals take this course while employed?

Yes, the program is designed with flexible online learning so professionals can continue working while studying. You can attend live sessions, access recorded lectures anytime, and complete projects at your convenience.

18. What career paths can I pursue after completing the program?

After completing the Professional Certificate Program in Financial Modelling and Analysis, you can explore roles like Financial Analyst, FP&A Specialist, Valuation Consultant, Equity Research Associate, or Investment Banking Analyst.

19. What kind of salary can I expect after completing this certification?

Professionals completing this course can earn between INR 6.5 to INR 17 LPA in India, depending on experience and role. Positions like Financial Analyst or Investment Banking Associate can offer even higher packages with growth potential.

20. Which companies hire professionals with this certification?

Top recruiters include PwC, KPMG, EY, Deloitte, JP Morgan, Goldman Sachs, Accenture, and TresVista. These companies value candidates with strong analytical and financial modelling skills from the program.

Course Certificates

Unlock Your Potential with Industry-Recognised Certifications

Earn a program completion certificate co-signed by PwC to validate your skills and knowledge acquired throughout the course

upGrad Learner Support

Talk to our experts. We are available 7 days a week, 10 AM to 7 PM

Indian Nationals

Foreign Nationals

Disclaimer

The above statistics depend on various factors and individual results may vary. Past performance is no guarantee of future results.

The student assumes full responsibility for all expenses associated with visas, travel, & related costs. upGrad does not .

%20(1)-d5498f0f972b4c99be680c2ee3b792d7.svg)

-ae8d039bbd2a41318308f8d26b52ac8f.svg)

-35c169da468a4cc481c6a8505a74826d.webp&w=128&q=75)

-7f4b4f34e09d42bfa73b58f4a230cffa.webp&w=128&q=75)