The old adage tells us that there are two sides to every coin, but what if it is just a bad penny? Case in point, the pandemic. It is all any of us have talked or thought about, and the sentiment is mostly negative. However, as the epidemic unfolded, we began realizing that some surprising positives may result in keeping economies afloat worldwide.

In this article, we will analyze the unprecedented rise in the sheer number of retail investors in the securities market.

What sets them apart?

Unlike institutional investors, usually banks, insurance companies, retirement funds, or hedge funds, retail investors are individuals like us who invest in their own volition, mostly through a broker.

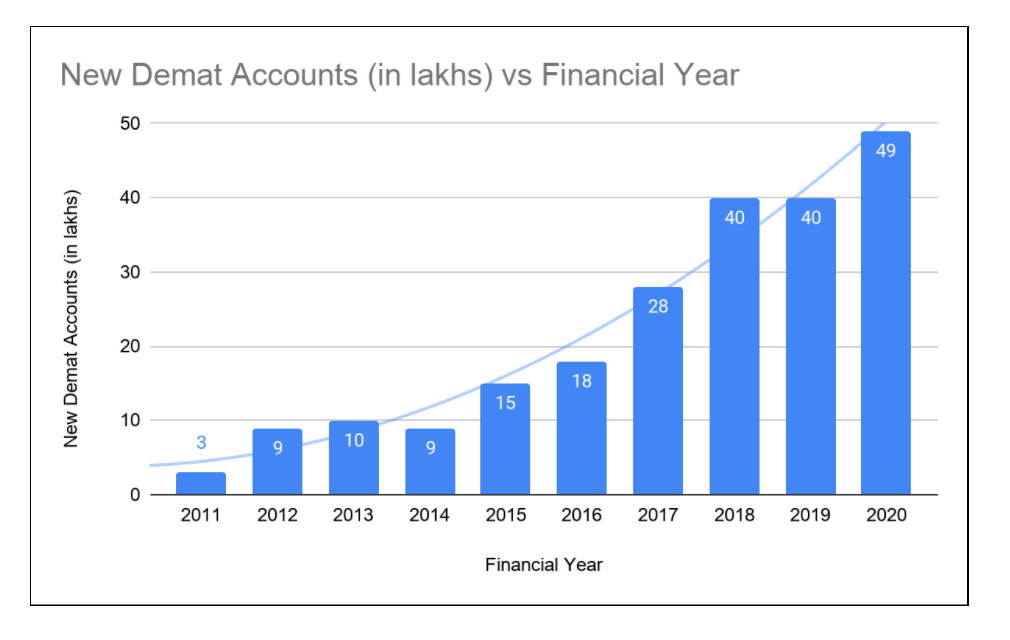

It has been observed that the number of retail investors, especially in the months – April, May, and June of 2020 have doubled, and Central Depository Services Limited (CDSL) shows that 19.6 lakh new accounts were added in these three months, which averages to 6.5 lakhs/month as opposed to 3 lakhs/month for the same period in FY 2019-20.

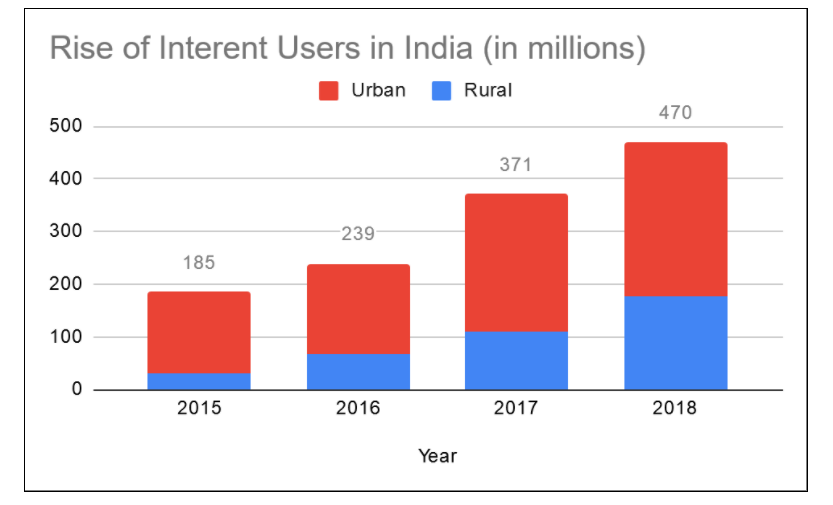

As we can see here, the trend is strong, and the growth has been nothing less than exponential since 2015, which begs the question of what happened in 2015?

The answer might be found in the Digital India Initiative, which made tier 2 and tier 3 cities and even suburban areas empowered with greater internet reach. Which means, everyone with a phone could take their financial future literally in their own hands.

According to the latest report, the Securities and Exchange Board of India (SEBI) is considering giving full direct market access to retail investors in India, which means that they’ll not need brokers to be able to invest in both BSE and NSE.

Data Source: Edelweiss Securities

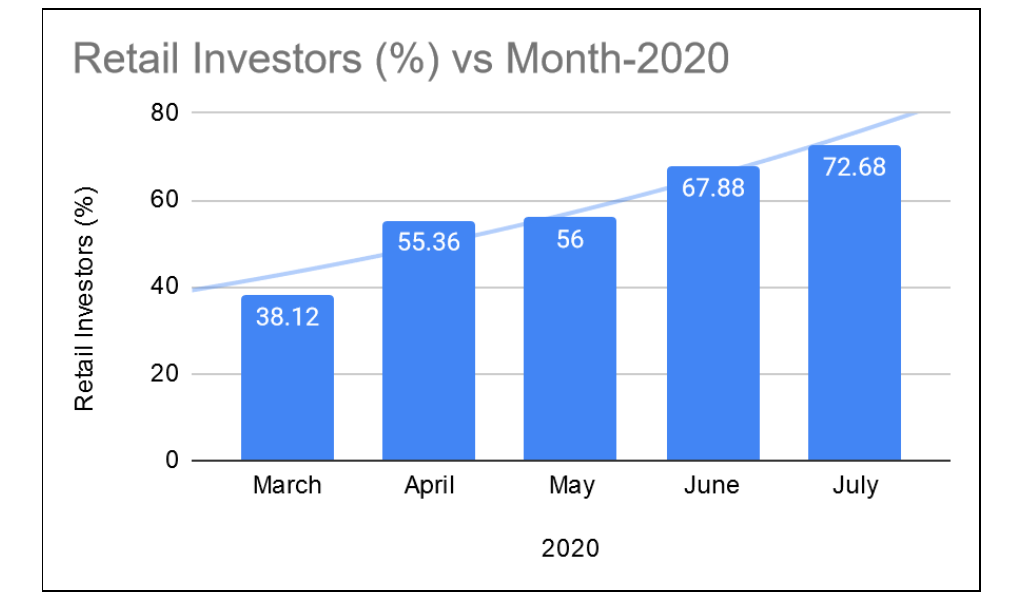

This act marks the change in the way the Indian workforce is entering the game at breakneck speed with a massive jump in the number of retail investors, from 45% in FY 2019-20 to 68% in June. There are reports that it has even breached the 70% mark in July!

Why the rise and why now?

It could be attributed to individuals with a steady income, looking for easy ways to save with high long-term returns, now that there is a less unnecessary expenditure, and there is more time in hand to self actualize the will to learn how financial markets work. A rise in salaries demands investment for a tax break.

Otherwise, high salaried people end up paying high tax (30% above 10 lakhs), but this can be brought down significantly if you are investing in certain tax-saving schemes. It could also mean that job security has become endangered during the pandemic. People have become more aware of the importance of saving money for a rainy day.

Although that might be a very broad way of looking at it, the pandemic has certainly allowed people to take a more focused approach with their equity investments, mutual funds, and commodities.

With gold closing at the highest price in over a decade at 55,675 INR for 10g of 24 carat as of 31st July 2020, there is a surge for selling and investing in gold, which currently is a more stable investment given the volatility of times.

Learn Digital Marketing Course online from the World’s top Universities. Earn Masters, Executive PGP, or Advanced Certificate Programs to fast-track your career.

But the way people are buying gold has also changed. Fundamentally when we think of investing in gold, we think physical gold. But many factors affect that decision like purity, safety, and so on, especially when the situation right now encourages one to invest in digital gold or ETF, which are exchange-traded funds traded on stock exchanges. They hold assets such as stocks, commodities, or bonds and are generally designed to keep their trading as close to their net asset value as possible.

Other reasons might be the significant rise in average national income or it might even be stress-related as everyone is looking at the future more precariously.

How is it happening now?

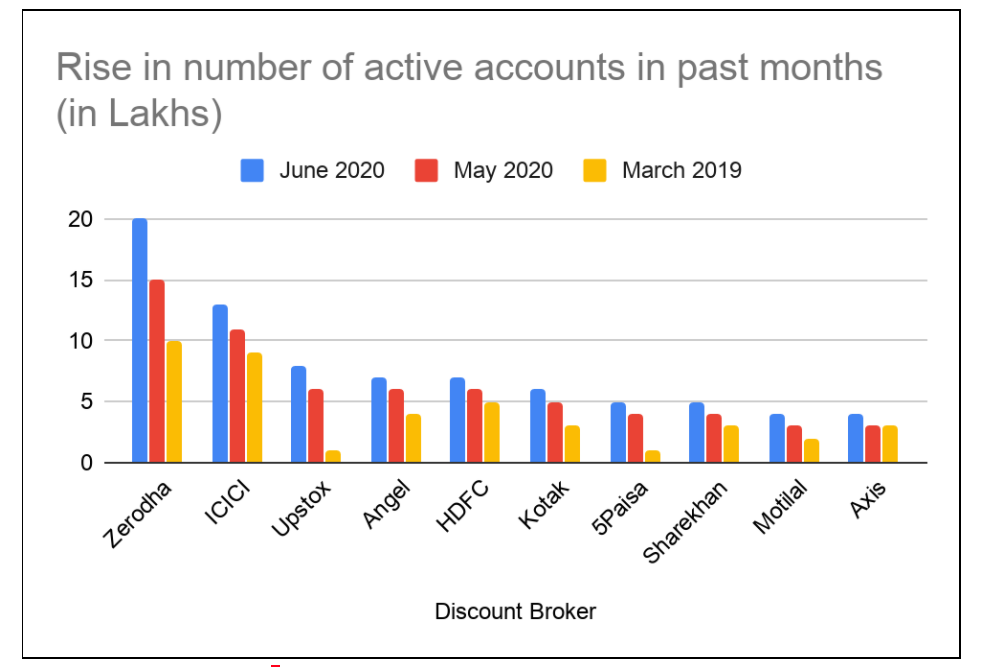

In addition to looking away from the traditional approach to investments (such as Banks FD and LIC) which arguably gives low returns, there is a rise in the number of discount brokers that are making it easier for even a layman to understand the intricacies of markets and encourage them to invest with ease. Discount brokers are those who allow individuals to invest in securities at minimum or zero brokerage.

Others reasons for more people opting for MF or Gold than LIC could be:

- No lock-in period – withdraw anytime, more flexibility and control over funds.

- Numerous options, depending upon understanding of sectors, risk appetite, and pocket

- Like LIC, MFs are also regulated by the government, so the risk of fraud is minimum.

- An option to switch from one fund to another giving more flexibility which is not possible with LIC.

- While compounding money grows with time, LIC ends after a fixed period and you cannot continue. However, MF can be held onto for as long as one wants thus, exponentially increasing the returns in the longer run.

- Better digital transaction facility which means more modern infrastructure and web design.

Applications like Binomo, Zerodha, 5paisa, and Upstox are quite popular with investors that fall under the younger age bracket with enthusiasm for making a quick buck through trading or dreams of getting higher returns on long term savings. Their priorities lie in preserving their future and living their best life in the present as well. Zerodha says that they’ve seen almost a 300% jump in new accounts joining in every month. Motilal Oswal team has also commented that their digital platform has handled more than a million trades per day since the lockdown.

Data Source : Business Insider

Apps are also a means to invest in foreign equity for institutional investors. Actually, some mutual funds invest exclusively in American companies. Although retail investors cannot directly invest in foreign markets as of today, apps like Zerodha and Upstox are trying to make that happen as they’re in talks with SEBI and other regulatory bodies.

An increase in the popularity of peer-to-peer lending and digital gold, shows that investors are empowered to make decisions to trade online confidently. Cryptocurrency, although shrouded in doubt since its inception, looks like an attractive way to securely store money as it maintains a distributed public ledger with the help of blockchain technology where all the transactions are accounted for.

Read: A Blue-print of the Pandemic Hit Auto Industry in India

What could be the impact?

The more money flows, the better it is for the economy since stagnant money doesn’t grow. India’s large population is its working class youth. The overall impact on the economy can be humongous and possibly positive.

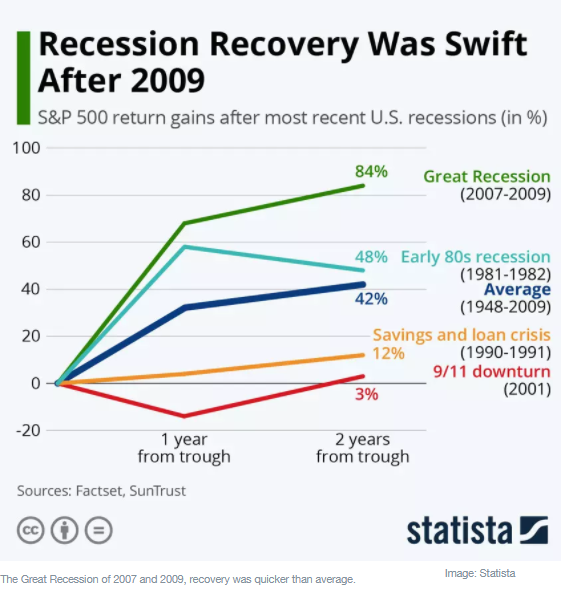

But throwing caution to the wind isn’t advisable as Aditya Narain, Head of Research at Edelweiss Financial Services, while talking to The Economic Times says, “Historically it has always happened like this after every major crisis.”

Source: Weforum.org

Taking the Global Depression in the account, there was a reasonably sharp bounceback. Nifty made a 40% jump from a low in March is a cause for celebration as well as keeping our eyes open for trouble.

With an increase in the number of investment instruments, digital platforms, and resources to gain financial literacy, it is certainly a great time for retail investors.

It’ll be interesting to see if this upward trend continues in the coming years and how it contributes to the overall economic growth and helps India transition into a financial superpower.

If you are curious to get into the world of digital marketing, check out upGrad & MICA’s Advanced Certificate in Digital Marketing & Communication.

![Top 15 Highest Paying Non-IT Jobs in India [2024]](/__khugblog-next/image/?url=https%3A%2F%2Fd14b9ctw0m6fid.cloudfront.net%2Fugblog%2Fwp-content%2Fuploads%2F2020%2F08%2F936-Highest-Paying-Non-IT-Jobs-in-India.png&w=3840&q=75)

![Top 15 Trending Online Courses in 2024 [For Both Students & Working Professionals]](/__khugblog-next/image/?url=https%3A%2F%2Fd14b9ctw0m6fid.cloudfront.net%2Fugblog%2Fwp-content%2Fuploads%2F2019%2F07%2FBlog_FI_July_upGrads-Career-advice.png&w=3840&q=75)

![10 Best Job-Oriented Short Term Courses Which are In-Demand [updated 2024]](/__khugblog-next/image/?url=https%3A%2F%2Fd14b9ctw0m6fid.cloudfront.net%2Fugblog%2Fwp-content%2Fuploads%2F2019%2F12%2F111-banner.png&w=3840&q=75)

![Top 25 Highest Paying Jobs in the World in 2024 [A Complete Guide]](/__khugblog-next/image/?url=https%3A%2F%2Fd14b9ctw0m6fid.cloudfront.net%2Fugblog%2Fwp-content%2Fuploads%2F2021%2F06%2F04134425%2F2112.png&w=3840&q=75)

![6 Top Career Options after BBA: What to do After BBA? [2024]](/__khugblog-next/image/?url=https%3A%2F%2Fd14b9ctw0m6fid.cloudfront.net%2Fugblog%2Fwp-content%2Fuploads%2F2020%2F06%2F554-Career-Options-after-BBA-.png&w=3840&q=75)

![Top 5 Highest Paying Freelancing Jobs in India [For Freshers & Experienced]](/__khugblog-next/image/?url=https%3A%2F%2Fd14b9ctw0m6fid.cloudfront.net%2Fugblog%2Fwp-content%2Fuploads%2F2020%2F12%2F1394.png&w=3840&q=75)