Summary

In this article, you will learn about the 12 Best Career Options after M.Com. Take a glimpse below.

- Enrol in an MBA Program

- Become a Chartered Accountant

- Consider doing the ACCA course

- Pursue Company Secretaryship

- Earn the CMA credential

- Complete the CFA course

- Obtain a CPA license

- Become an FRM-certified professional

- Crack the CFP exam

- Get into digital marketing

- Get CIB certified

- Pursue a career in teaching and research

Read the full article to know more details like Salary Range, career scope etc.

What to do after M.Com?

How many of you wonder which are all the best career options after M.Com? Master of Commerce (MCom) is a popular two-year postgraduate degree offered by several recognized universities in India. Its curriculum is a level up from the concepts that you learn about in a BCom program. Typically, students opt for an MCom qualification to delve deeper into the professional spheres of accounting, taxation, banking, finance, and insurance.

But choosing a career path from a variety of alternatives without any guidance can prove tricky. It is not easy to find high paying jobs for M.Com graduates if one has not chosen the right courses after M.Com. One has to know the list of all job opportunities after M.Com to select the right one.

You can also check out our free courses offered by upGrad in Management, Data Science, Machine Learning, Digital Marketing, and Technology.

Learners receive an average Salary hike of 58% with the highest being up to 400%.

If you, too, are a young graduate and wondering what jobs to do after M.Com, this article is for you. As a commerce student, you get exposure to a plethora of business and management-related subjects. So, you would have gained the foundational knowledge upon which you can build a dynamic career. We have compiled a list of prospective work lines below that you can explore after attaining an MCom degree.

Enrol on digital marketing programs and dive into the digital era.

Career Options After MCom

Below is a list of some great courses after M.Com job opportunities which you can choose.

1. Enroll in an MBA Program

MBA is the most popular course available for students & one of the best courses after M.Com, not just graduating from commerce but any other field. An MBA degree finds a place among the most preferred options among candidates who want to qualify for managerial positions and advance their careers. While studying MCom, you learn about business, economics, stock markets, accountancy, among other things. But when you pursue higher education in business administration, you also learn how to apply your technical know-how to solve problems and help organizations grow.

After earning an M.Com, enrolling in an MBA program has several appealing advantages that make it a wise decision for both professional and personal development. Statistics reveal that the employability of Indian MBA graduates has increased to 60% in 2023. The jobs after M.Com added with an MBA give wider opportunities to the aspirant, for instance:

- Expanded Career Prospects

Managerial Roles: An MBA prepares you for managerial and leadership roles in a variety of industries by giving you the know-how to successfully manage teams and negotiate challenging business situations.

Versatility: An MBA gives you a broad skill set that allows you to choose a job that permits you to switch between different industries or roles.

- Developing Leadership

Strategic Thinking: MBA programs place a strong emphasis on problem-solving, critical thinking, and strategic decision-making. These skills develop your capacity to assess situations and make well-informed managerial decisions.

Team Management: Mastering interpersonal skills, communication, and team management—all crucial components of good leadership—is the main emphasis of leadership courses in MBA programs.

Check out our programs – MBA from Golden Gate University, MBA from Deakin Business School & Post Graduate Diploma in Management From BIMTECH

Most MBA programs follow a case study pedagogy to equip students with the critical thinking and decision-making capabilities. Nowadays, leading academic institutions are offering Global MBA degrees online on platforms like upGrad. These are accredited courses that allow you to continue your academic pursuits and get mentored by industry experts in a flexible learning environment. Additionally, you can specialize in a particular field such as business analytics, digital finance, and banking, etc.

Looking to leverage your commerce background? Dive into the wide range of career options for commerce students and unlock the door to numerous opportunities that await you in the business world.

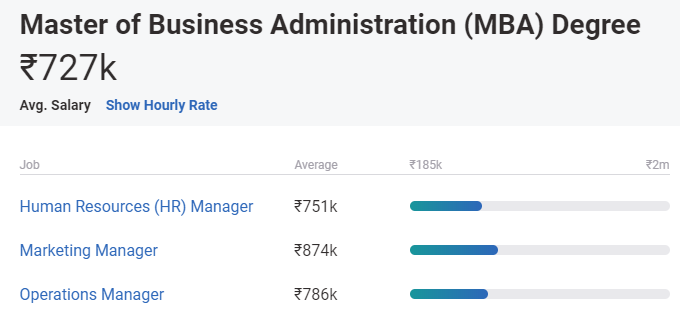

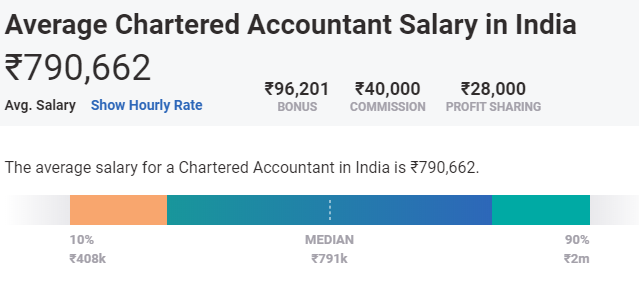

According to payscale, the average salary of MBA graduates is 7.2 LPA in India.

List of popular companies for MBA graduates:

Read: 14 Best Career Options after B.Com: What to do After B.Com?

2. Become a Chartered Accountant

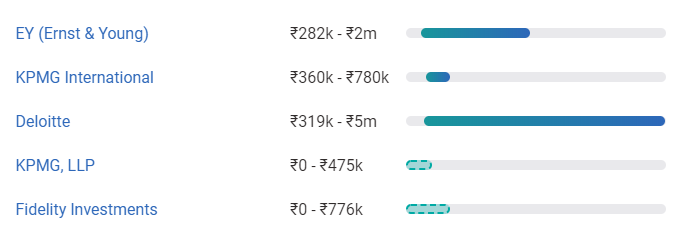

Chartered Accountancy or CA has proven to be one of the top-most career options after MCom. You are eligible to take the exam right after high school, but it demands dedicated preparation. After qualifying the three stages of CPT, IPCC, and Finals, you will need to complete an articleship of 2.5 years to practice professionally. Many talented CA graduates find employment in the ‘Big 4’ accounting firms—namely Deloitte, KPMG, EY, and PwC—earning an average annual salary of INR 8 lakh. CA is one of the best courses after M.Com for getting good jobs and salaries.

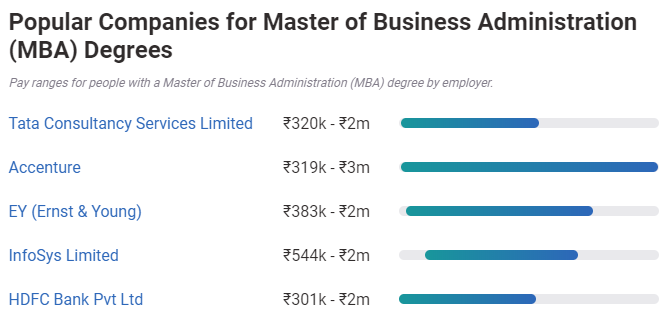

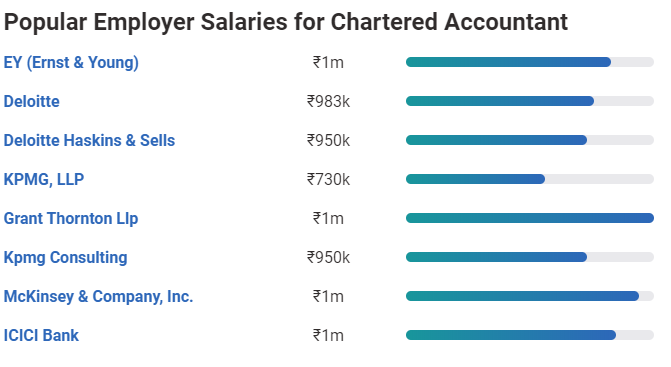

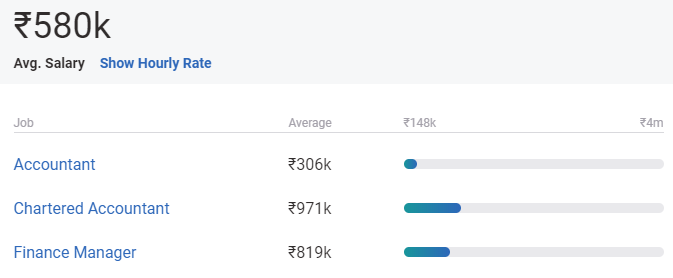

Average salary of CA graduates is Rs. 7.9 LPA in India

Top employers for CA graduates:

Becoming a Chartered Accountant (CA) presents a number of noteworthy benefits and chances for career advancement. After M.Com job opportunities for a CA depends heavily on his skills. The following are strong arguments in favor of obtaining a CA certification after M.Com courses:

- Domain-Specific Knowledge

Accounting Knowledge: Greater depth in accounting principles, taxation, auditing, and financial management is provided by the CA program, which offers specialized knowledge not covered by M.Com.

Practical Training: Articleship component of the CA program gives students hands-on experience in accounting, auditing, and taxation procedures in the real world, which boosts their employability.

- Elevated Industry Need

Coveted Qualification: In the corporate, public, consulting, finance, and other sectors, the CA designation is highly valued and in demand.

Numerous Career Paths: Certified Public Accountants (CAs) can pursue a wide range of careers, from positions in senior finance in corporations to positions in Big 4 accounting firms.

- Flexibility and Range

Worldwide Recognition: The CA credential is accepted around the world, opening doors to employment in international markets and conglomerates.

Different Roles: Certified Public Accountants (CPAs) have a wide range of career options, including roles in accounting, auditing, taxation, financial management, consulting, and advisory.

Curious about the most lucrative career paths in commerce? Explore our detailed guide on the highest paid jobs in India in commerce, and aim for a prosperous future in the business world.

salary of CA graduates Experience Wise

| Experience | Salary |

| 1 Year | ₹6.7 Lakh |

| 2 Year | ₹7.1 Lakh |

| 3 Year | ₹7.5 Lakh |

| 4 Year | ₹8.1 Lakh |

| 5 Year | ₹8.5 Lakh |

3. Consider doing the ACCA course

If you wish to work in accounting and finance, you can also consider pursuing the ACCA Course (Chartered Certified Accountant) qualification provided by the Association of Chartered Certified Accountants (ACCA) institute. The two-year course is highly valued in multinational corporations. But before you become an official ACCA member, you will also need to complete three years in a practical setting.

The minimum eligibility is a 10+2 educational qualification with at least a 65% aggregate score in Math, Accounts, and English and 50% in other subjects. So, many students from the commerce stream enroll in the program during their undergraduate studies only. But even if you are an MCom student, your sound understanding of accounting concepts will help you in clearing the exams. ACCA is one of the most preferred courses after M.Com.

Still wondering after M.Com which course is best? Enrolling in the ACCA program might be the best answer. With its many benefits, it will improve your professional prospects and fit in with your career goals. The following are compelling reasons to go after the ACCA certifications for your career after M.Com:

- Recognition on a Global Scale

Global Acceptance: ACCA is respected and well-known throughout the world, providing employment opportunities in a number of nations and multinational companies.

International Accounting Standards: By providing you with knowledge in line with these standards, ACCA allows you to pursue career opportunities that transcend national boundaries.

- All-encompassing Skill Set

Curriculum Variety: ACCA offers courses on financial accounting, management accounting, taxation, auditing, and strategic business management, among other accounting and finance subjects.

Practical Applications: The program places a strong emphasis on practical application, equipping you with the skills necessary to handle real-world situations and obstacles in accounting and finance roles.

Multinational companies have a high demand for the graduates of this course and pay a salary ranging from 5 to 16 lakhs.

Top companies hiring ACCA

ACCA Salaries With Job Roles

| Job Title | Range | Average |

| Accountant | ₹172k – ₹729k | ₹348,171 |

| Chartered Accountant | ₹364k – ₹2m | ₹985,808 |

| Finance Manager | ₹197k – ₹2m | ₹967,750 |

| Auditor | ₹300k – ₹2m | ₹625,710 |

| Associate Auditor | ₹252k – ₹839k | ₹398,739 |

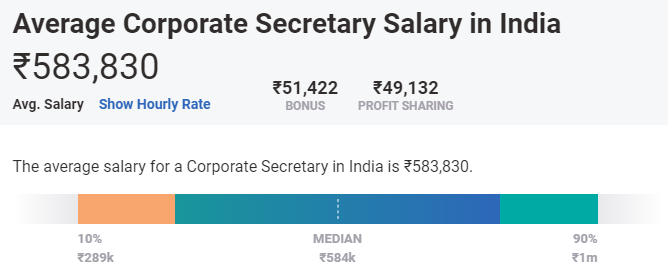

4. Pursue Company Secretaryship

If you are wondering what to do after M.com for good job opportunities, Company Secretary (CS) is one of the many pivotal job roles in an organization. A Company Secretary (CS) looks after the legal compliance and regulatory requirements of public and private sector companies. The three stages of the CS course include a Foundation, Executive, and Professional. The candidates also have to undergo 15 months of practical training, after which they become an Associate CS and earn an ICSI membership. ICSI refers to the Institute of Company Secretaries of India, which is the only recognized body providing the CS course in the country, boasting of more than 62,000 members.

Pursuing a career as a company secretary is one of the best courses after M.Com for the following reasons:

- Harmonious Skill Set

Legal and Corporate Expertise: In addition to the financial expertise obtained from an M.Com, company secretaryships offer specific knowledge in corporate laws, governance, compliance, and secretarial practices.

Comprehensive Understanding: CS courses extend your knowledge beyond accounting and finance by covering legal, secretarial, and administrative topics.

- Knowledge of Corporate Governance

Regulation Adherence: CS qualifications emphasize upholding corporate laws and governance practices, which equips you with the skills necessary to keep organizations compliant with laws and regulations.

Board Advisory Role: CS specialists frequently serve as counselors to the board of directors, offering advice on corporate strategy, legal issues, and compliance needs.

The salary range of CS in India ranges between Rs 4 – 10 LPA. According to PayScale the average salary of CS is Rs. 5.8 LPA.

Company Secretary Salaries in India

| Location | Average Annual Salary |

| Bangalore | ₹9.5 Lakhs |

| New Delhi | ₹8 Lakhs |

| Mumbai | ₹9.7 Lakhs |

| Kolkata | ₹6.9 Lakhs |

| Hyderabad | ₹9 Lakhs |

| Chennai | ₹12.3 Lakhs |

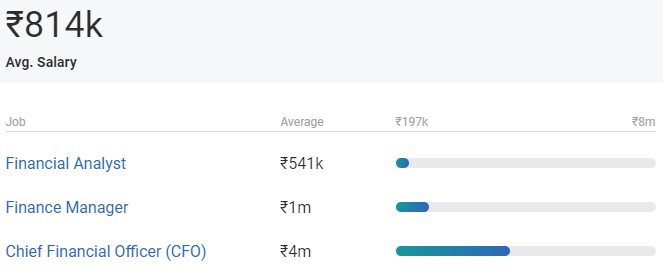

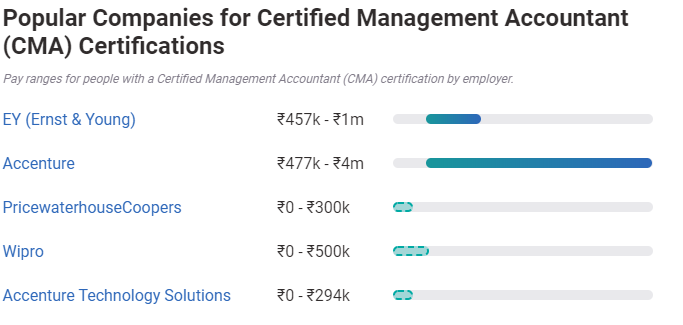

5. Earn the CMA credential

Certified Management Accountant (CMA) is a professional course requiring aspirants to complete two stages of examination and gain two years of work experience. This prestigious credential is offered by the IMA, an association based in the United States, and enjoys global recognition which made this one of the best courses after M.Com.

CMA-certified individuals are acknowledged for their expertise in two core areas – management accounting and financial management. They are expected to be knowledgeable in financial analysis, planning, control, and decision support. You will find that corporate recruiters prefer hiring CMA holders for such profiles. CMA is one of the preferred courses after M.Com.

If you are still wondering, ‘what can i do after M.Com?’, obtaining the Certified Management Accountant (CMA) credential can greatly enhance your career prospects within the financial management industry. The following reasons show how:

- Expertise in Management Accounting

Focused Expertise: The CMA gives you specialized knowledge in management accounting with a focus on cost control, performance assessment, and strategic financial management.

Decision-Making Skills: The main goal of CMA courses is to improve your capacity to make data-driven financial decisions, essential for the success of organizations.

- Demand in the Industry and Professional Growth

High Demand: Because of their proficiency in cost management, strategic planning, and financial analysis, jobs after M.Com for CMA qualified professionals are in high demand.

Career Progression: CMA credentials open doors to senior managerial roles in accounting and finance departments, providing ample opportuniy for professional growth.

Average salary of CMA is Rs. 8.1 LPA in India

List of top employers for CPA

Also read: Career options in science after graduation

Certified Management Accountant (CMA) Salary in India

| Location | Average Annual Salary |

| Bangalore | ₹4 Lakhs |

| Mumbai | ₹ 3.6 Lakhs – ₹ 10.4 Lakhs |

| Kolkata | ₹ 2.7 Lakhs – ₹ 3.5 Lakhs |

| Hyderabad | ₹6 Lakhs |

| Chennai | ₹10.5 Lakhs |

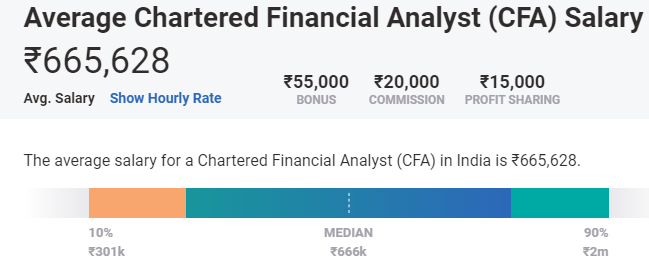

6. Complete the CFA course

CFA is one of the best courses after MCom. CFA stands for the Chartered Financial Analyst program. Offered by the US-based CFA institute, it presents a great doorway into the world of investment and finance. The program covers topics related to financial analysis, bonds and derivatives, portfolio and investment management, etc. Once you are through with the three tiers of CFA, you can be hired by some of the top global financial firms, such as Goldman Sachs, JP Morgan, Royal Bank of Canada, and Morgan Stanley.

Also, Check out online degree programs at upGrad.

To be eligible to take the Level-I exam, you should be in the final year of your undergraduate degree. Although the duration of the course is 2.5 years, it takes an average of four years to attain the tag of a CFA Charter.

Are you still worried about which M.Com specialization is best after earning an M.Com? Take a look at the advantages CFA certification offers to make up your mind.

- Comprehensive Financial Understanding

Extensive Curriculum: The CFA program offers a deep understanding of financial concepts by delving into financial analysis, investment management, portfolio management, ethics, and economics.

Quantitative Skills: It places a strong emphasis on quantitative analysis, giving you the tools you need to successfully assess and manage investment portfolios.

- Emphasis on Investment and Portfolio Management

Specialized Knowledge: The CFA program prepares candidates for positions in investment banking, asset management, and financial planning by concentrating primarily on investment analysis, asset valuation, and portfolio management.

Risk Managerial Skills: The program strongly emphasizes risk assessment and management, which are essential in modern day intricate financial markets.

Average salary of Chartered Financial Analyst is Rs. 6.6 LPA

How the city you work affects your pay:

Salary range of Chartered Financial Analyst in India

| Job Roles | Average Salary (INR) | Top Location |

| Associate Financial Analyst | ₹ 12,00,000 – 18,00,00 | Mumbai, Bangalore |

| Private Banker | ₹8,00,000 – 14,00,00 | Mumbai, Delhi |

| Risk Manager | ₹ 9,00,000 – 16,00,00 | Mumbai, Delhi |

| Policy Associates | ₹ 7,00,000 – 12,00,00 | Delhi, Mumbai |

| Relationship Manager | ₹ 6,00,000 – 9,00,00 | Mumbai, Bangalore |

| Chief Executive Officer | ₹ 21,00,000 – 35,00,00 | Mumbai, Bangalore |

| Banking Relationship Manager | ₹ 10,00,000 – 17,00,00 | Mumbai, Delhi |

| Chartered Financial Analyst | ₹ 17,00,000 – 25,00,00 | Mumbai, Delhi |

| Corporate Affairs Manager | ₹ 13,00,000 – 21,00,00 | Mumbai, Delhi |

Checkout: Highest Paying Commerce Jobs in India

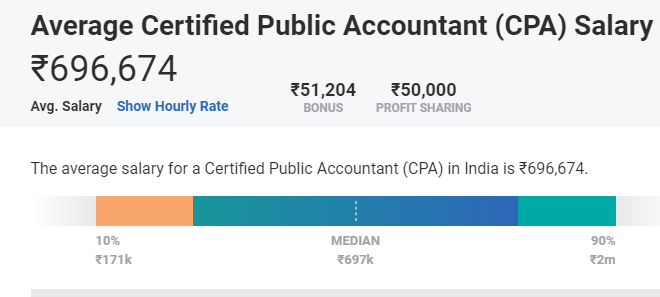

7. Obtain a CPA license

One of the most prevalent career options after M.Com is the Certified Public Accountants certification. CPAs attain their designation from the American Institute of CPAs or AICPA. Individuals who possess a CPA license have an in-depth understanding of the Generally Accepted Accounting Principles (GAAP) and a robust accounting background. To acquire the certification, you will have to take a rigorous four-part exam.

Now, let us understand what CPAs do in a company. Basically, they perform the financial statements auditing and attestation functions, helping investors know about the financial health of a firm. They also provide taxation and financial planning advice to individuals and organizations.

CPA is one of the many courses you can pursue if you are looking for answers to which courses are available after M.Com. Earning a Certified Public Accountant (CPA) license has many benefits and opportunities in accounting, finance, and auditing.

- Professional Trust and Credibility

Credibility and Trustworthiness: Professional competence, adherence to high ethical standards, and a commitment to upholding financial integrity are all indicated by holding a CPA license.

Client Confidence: Because of their knowledge of finances and adherence to accounting rules, CPAs are frequently trusted by both employers and clients.

- Practice privileges and regulatory requirements

Regulatory Requirements: To ensure adherence to legal standards, several jurisdictions mandate a CPA license for specific accounting and auditing roles.

Practice Privileges: Signing and certifying financial statements is a common privilege for CPAs, which strengthens their role in assurance and auditing services.

The average salary of CPAs in India is Rs. 6.9 LPA.

8. Become an FRM certified professional

Still, need options for jobs after M.Com with a good salary? Risk Management is a thriving industry in today’s dynamic financial market. FRM is an excellent option for those looking for short-term courses. To earn the designation, you have to undergo a nine-month program facilitated by the Global Association of Risk Professionals or GARP. The examinations are conducted in two rounds, in May and November.

An FRM certification is an indicator of your ability to identify and analyze potential financial threats. As a financial risk manager, you can offer your services in diverse domains like credit and market risk, financial services, trading, sales and marketing. Payscale assesses the average salary of FRM professionals to be between 10 to 18 lakh per annum.

After M.Com, which course is best? In the field of risk management and finance, earning an M.Com grants you access to various benefits, one of which is becoming a certified Financial Risk Manager (FRM) professional. The following are strong arguments in favor of obtaining the FRM certification:

- Proficiency in Risk Assessment

Comprehensive Understanding: Having earned an FRM certification gives one access to extensive knowledge of market, credit, operational, and liquidity risk as well as financial risk management.

Analytical Skills: FRM gives you the sophisticated quantitative abilities you need to recognize, evaluate, and control the many kinds of financial risks that businesses face.

- Practical Skills Relevant to the Industry

Real-World Application: Case studies, simulations, and hands-on exercises are all part of FRM programs, which give students practical experience managing actual financial risks.

Quantitative Techniques: Because FRM is centered around quantitative analysis, you can make use of advanced risk management models and tools.

After completing this course, your average salary range will be anywhere between Rs 10 – 18 LPA in India.

Top employers for Risk Manager in India

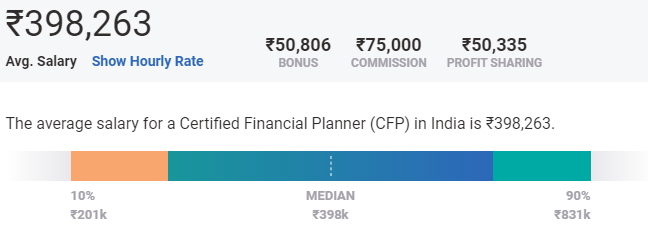

9. Crack the CFP exam

One of the most popular career options after M.Com is doing CFP course. CFP is another short-term course that can help you find avenues in the finance and insurance sectors. Although the course duration is six months, you need to perform well in other parameters to practice as a Certified Financial Planner. These requirements include your educational performance, demonstrated work experience, and professional ethics. With a CFP certification, you can take up assignments in tax planning, insurance decisions, estate planning, investment management, retirement, etc.

If you are still looking for answers to which courses are available after M.Com, the Certified Financial Planner (CFP) course can be the best fit. Passing the CFP exam can be beneficial for a number of reasons.

- Comprehensive Financial Planning Expertise

Comprehensive Understanding: A variety of topics related to financial planning are covered in CFP education, such as investments, risk management, insurance, taxes, retirement planning, estate planning, and risk management.

Client-Centric Approach: Earning a CFP gives you the tools to give thorough financial advice that is customized to meet the needs of each client.

- Credibility as a Professional and Client Trust

Trusted Financial Advisor: Having a CFP certification shows clients that you are dedicated to upholding professional standards and ethical behavior, which fosters client confidence.

Comprehensive Financial Planning: Because CFP specialists are knowledgeable in a wide range of financial topics, clients frequently turn to them for all-encompassing financial advice.

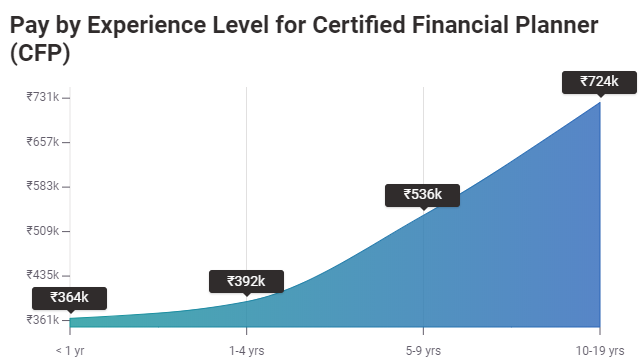

Average salary of certified financial planners is Rs. 3.9 LPA in India

How it increases with years of experience:

10. Get into digital marketing

For all the students who are wondering what to do after Mcom, If you are not interested in working in the realm of finance and accounting, deciding what to do after MCom can be challenging. It comes as no surprise that many commerce students choose creative occupations as well. One of these innovative pursuits includes digital marketing. It is a component of marketing that uses digital technologies to promote products and services. Modern-day businesses cannot neglect the power of the internet, and thus, this field has gained immense popularity in recent years.

Digital Marketing Free courses to Learn

Also read, Career options in medical for non-commerce students

There are numerous digital marketing courses in the market, with their duration varying between 3 months and 11 months. The coursework emphasizes teaching topics like Search Engine Optimization (SEO), Pay Per Click (PPC), content marketing, social media management, marketing analytics, digital branding, etc. You can check out the online PG certification in digital marketing and communication by reputed institutes like MICA on upGrad.

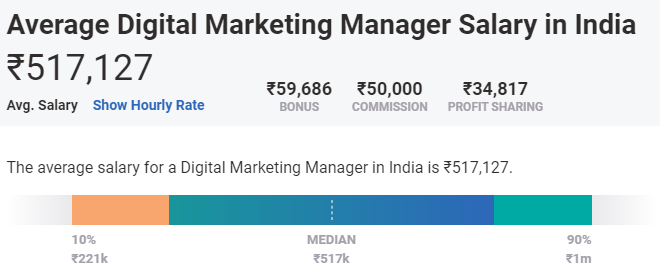

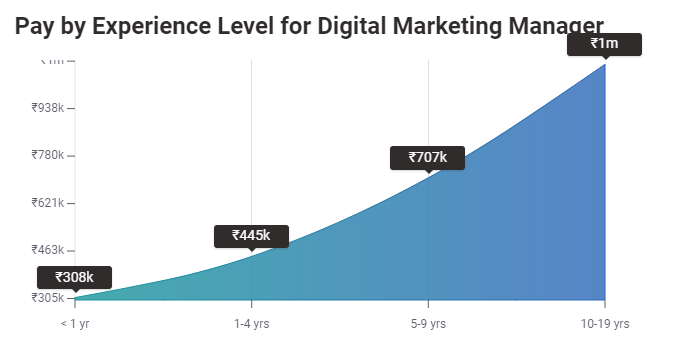

Knowledge of digital marketing can lead to a highly promising career in the current work environment where everyone, from corporate bigwigs to ad agencies and startups, is on the lookout for digital marketers and managers. According to Payscale, a digital marketing professional in India can earn a starting salary of around INR 5 lakh per annum. And digital marketing managers can get paid as high as 15 lakh per annum, depending on their job profile.

Check out digital marketing jobs.

How your pay increases with years of experience:

Digital Marketer Salaries in India

| Experience | Salary |

| 2 Year | ₹5.0 Lakh |

| 3 Year | ₹5.8 Lakh |

| 4 Year | ₹7.0 Lakh |

| 6 Year | ₹8.3 Lakh |

| 8 Year | ₹9.7 Lakh |

| 10 Year | ₹10 Lakh & Above |

11. Get CIB certified

CIB is short for Certificate in Investment Banking, a six-month course for graduates who want to raise capital for companies by selling equity and issuing debt. It is a globally recognized examination that tests whether you can employ systematic and strategic methods to establish the valuation of listed and unlisted companies. Determining the right valuation forms a crucial part of investment decisions relating to Initial Public Offerings, mergers, acquisitions, and other corporate actions.

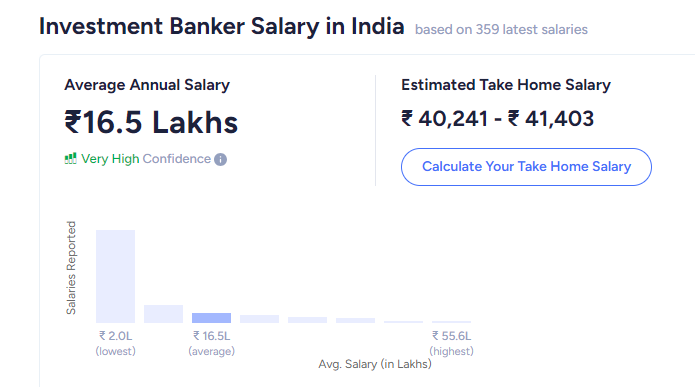

You can go for the CIB course right after your BCom. But having an MCom degree will make it easier for you to grasp the coursework, which contains themes of asset management, equity research, hedge funds, corporate finance strategy, and private wealth management. Payscale estimates an investment banking career can get you an average annual salary of INR 9.6 lakh in India.

12. Pursue a career in teaching and research

If Business and Commerce interest you as academic disciplines, you can even enter the research field. A doctorate or Doctor of Philosophy (Ph.D.) is awarded in majors like Finance, Statistics, Operations Research, Organizational Behavior, Human Resource Management, and many others. You can also look for a suitable program of study abroad provided that it meets your research interests. It is one of the best career options after MCom.

If you want to gain skills into various facets of business and trade through research, embarking on a PhD journey in one of these fields could be a desirable path. To initiate this journey, look for a suitable international research program aligned with your interests could be a fantastic initial step to know after M. Com which course is best.

Apart from JRF, there are a number of national and international fellowships available for students exhibiting high research aptitude in Commerce, Economics, and Management. If you want to become a university lecturer, studying your way to a Ph.D. degree is highly recommended. But if you are more inclined towards teaching school students, you can opt for the two-year B.Ed program.

Here are some bonus jobs you can take after doing M.Com.

Candidates with an M.Com degree are prepared for careers as auditors, business analysts, company secretaries, consultants, tax accountants, finance officers, stock brokers, sales analysts, and economists. An M.Com graduate might also go for government exams to gain jobs in the public sector. Following are a few of the well-paying jobs after m.com with a high salary.

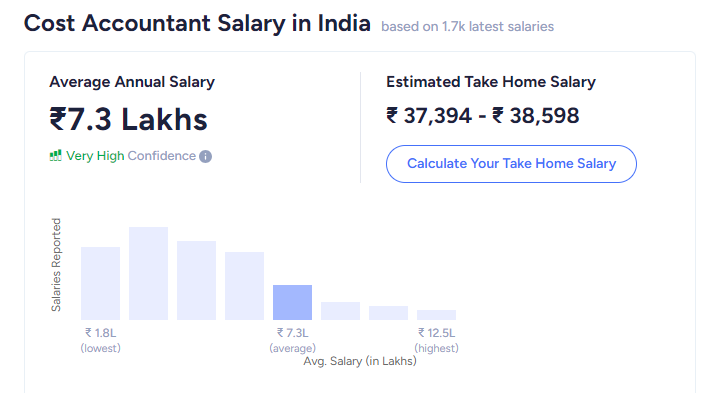

1. Cost Accountant

A cost accountant is a financial professional who analyses the expenses related to providing a service or producing it. A cost accountant’s main responsibilities include analysing a position and establishing a budget to make it profitable, as well as examining the total profit and loss statement. A cost accountant also accounts for the expenses related to administration, shipping, and production.

A person can pursue professional courses to gain a deeper knowledge of Cost and Management Accounting, even though the knowledge acquired during an M.Com degree course is likely to land them a solid position as a cost accountant.

2.Tax Consultant

Looking for post M.Com job opportunities? Become a Tax Consultant. A tax consultant or job in taxation centres on specialists assisting people with their tax-related questions and assisting them in both short- and long-term tax optimisation. The majority of tax advisors have degrees in law, accounting, finance, or a closely connected discipline. Understanding accounting theory, practise, and laws, as well as tax laws and financial management, are prerequisites for establishing a profession as a tax consultant.

One can work in a tax consulting firm with an M.Com degree, however, tax consulting organisations prefer people having an LLB degree to handle legal tax concerns.

3. Sales Analyst

After M.com courses, you can choose to become a sales analyst. A sales analyst is a specialist employed by a company to assess and pinpoint historical sales trends. By analysing market data, sales analysis will help businesses grow. Sales analysts provide a clearly defined plan in the form of weekly or monthly reports and offer it to the upper management and sales staff. A sales analyst’s duties also include conducting significant marketing campaigns and spotting emerging market trends in sales.

When analysing the flaws, a sales analyst reflects the supply chain, marketing, and manufacturing systems of the organisation. Candidates with an M. Com degree and a strong interest in sales and marketing are a perfect fit for the position of sales analyst. The M.Com degree holder has sufficient financial understanding to create an appropriate plan of action.

4. Investment Banker

After M.Com, there are many job opportunities on your way. One such option is Investment Banker. Investment bankers are experts who assist businesses, governments, and other entities in raising funds from a variety of sources. Investment bankers are the specialists that financial institutions hire to assess an organisation’s financial standing, capital requirements, and goals. The main responsibility of an investment banker is to serve as a liaison between entities that raise funds and those willing to make financial investments, in addition to outlining issues and offering potential solutions.

Wrapping up

The above is a list of some great career options after M.Com. We hope it will answer your question “What to do after M.Com?”. You can determine your interest based on your career choice that you would like to opt for after your graduation. For all young minds, wondering what to do after M.Com, you need to check the amount of time, the difficulty level, and the price of the course, before deciding which course to opt after your graduation. Any of the above best courses after M.Com are sure to land you a great job so that you can happily start your journey in the professional world.

Now that we have detailed a range of different career options after MCom, it would be relatively easy for you to locate your interests. So, gather some more information about your preferred choices and follow the path you desire!

Also Read: Top 10 Highest Paying Jobs in India

Wrapping up

The above is a list of some great career options after M.Com. We hope it will answer your question “What to do after M.Com?”. You can determine your interest based on your career choice that you would like to opt for after your graduation. For all young minds, wondering what to do after M.Com, you need to check the amount of time, the difficulty level, and the price of the course, before deciding which course to opt after your graduation. Any of the above best courses after M.Com are sure to land you a great job so that you can happily start your journey in the professional world.

Now that we have detailed a range of different career options after MCom, it would be relatively easy for you to locate your interests. So, gather some more information about your preferred choices and follow the path you desire!

![12 Best Career Options after M.Com: What to do After M.Com? [2024]](/__khugblog-next/image/?url=https%3A%2F%2Fd14b9ctw0m6fid.cloudfront.net%2Fugblog%2Fwp-content%2Fuploads%2F2020%2F08%2F888.png&w=1920&q=75)

![Top 15 Highest Paying Non-IT Jobs in India [2024]](/__khugblog-next/image/?url=https%3A%2F%2Fd14b9ctw0m6fid.cloudfront.net%2Fugblog%2Fwp-content%2Fuploads%2F2020%2F08%2F936-Highest-Paying-Non-IT-Jobs-in-India.png&w=3840&q=75)

![Top 15 Trending Online Courses in 2024 [For Both Students & Working Professionals]](/__khugblog-next/image/?url=https%3A%2F%2Fd14b9ctw0m6fid.cloudfront.net%2Fugblog%2Fwp-content%2Fuploads%2F2019%2F07%2FBlog_FI_July_upGrads-Career-advice.png&w=3840&q=75)

![10 Best Job-Oriented Short Term Courses Which are In-Demand [updated 2024]](/__khugblog-next/image/?url=https%3A%2F%2Fd14b9ctw0m6fid.cloudfront.net%2Fugblog%2Fwp-content%2Fuploads%2F2019%2F12%2F111-banner.png&w=3840&q=75)

![Top 25 Highest Paying Jobs in the World in 2024 [A Complete Guide]](/__khugblog-next/image/?url=https%3A%2F%2Fd14b9ctw0m6fid.cloudfront.net%2Fugblog%2Fwp-content%2Fuploads%2F2021%2F06%2F04134425%2F2112.png&w=3840&q=75)

![6 Top Career Options after BBA: What to do After BBA? [2024]](/__khugblog-next/image/?url=https%3A%2F%2Fd14b9ctw0m6fid.cloudfront.net%2Fugblog%2Fwp-content%2Fuploads%2F2020%2F06%2F554-Career-Options-after-BBA-.png&w=3840&q=75)

![Top 5 Highest Paying Freelancing Jobs in India [For Freshers & Experienced]](/__khugblog-next/image/?url=https%3A%2F%2Fd14b9ctw0m6fid.cloudfront.net%2Fugblog%2Fwp-content%2Fuploads%2F2020%2F12%2F1394.png&w=3840&q=75)